First Quarter 2015 Market Commentary Now Posted

We recently posted our First Quarter 2015 Market Commentary to the News & Analysis page! The Market Commentary includes our review of market developments in the first quarter, as well as our outlook for the second quarter 2015 and beyond. The content of the Market Commentary is reproduced below:

FIRST QUARTER 2015 MARKET COMMENTARY

EXECUTIVE SUMMARY

With volatile energy prices and the specter of interest rate hikes looming over the market, the Dow experienced almost daily triple-digit trading sessions for much of the quarter. Despite this volatility, the S&P 500 and the Dow ended up basically flat in the first quarter, with the Russell Value Index down 1.3%.

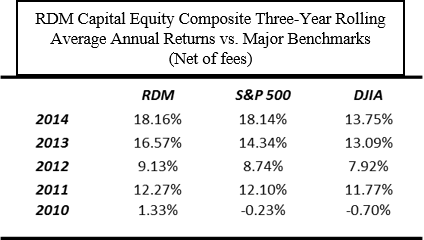

The RDM composite of equity-oriented client accounts also was flat for the quarter, with a small gain before fees, essentially even with the S&P 500 and Dow and outperforming the Russell. More importantly, our three-year rolling performance after fees continues to outperform the S&P 500 and Dow. (See below). Considering our investment horizon for most accounts is at least three years, our performance is best measured over this longer period.

Past performance is not indicative of future results.

Commodities continued to exacerbate the market volatility with further declines in the price of crude oil. The over-supply of crude that surprised the market last year continues, as inventory levels remain high and prices weak. The war between U.S. shale oil producers and middle-east OPEC producers over global demand is not likely to end soon, with OPEC, i.e. Saudi Arabia, seemingly set on forcing a much larger proportional cut out of U.S. producers to maintain its market share. As a result, the U.S. consumer continues to benefit from lower home heating and transportation costs, while U.S. businesses in the energy sector cut back on expenses to adapt to a new low price environment.

As foreign central banks embark on their own quantitative easing at the same time that the Fed threatens to tighten U.S. monetary policy, the dollar has risen over 20% against the euro. The stronger dollar has significant implications for earnings of American multi-national companies and international trade and likely impacts the Fed’s upcoming interest rate decisions.

We believe the equity markets remain attractive, however we are cautious and extremely selective in deploying capital due to currently higher equity valuations than in recent years and elevated market volatility. Within equities, we see opportunities within the financial, energy and healthcare sectors, as well as Europe, which appears likely to rebound over the medium to long-term. As has been a theme in our letters for several quarters, we believe fixed income will likely under-perform over our 3-5 year timeframe as the threat of rising interest rates inches closer to becoming reality. We favor a multi-asset class portfolio of income oriented securities for more conservative clients in order to diversify interest rate risk.

Market Volatility

Equity markets in 2015 saw an uptick in volatility. Daily triple digit moves in the Dow, particularly in January and March, seemingly became the norm. Volatility abated at times during the recovery from the financial crisis, as accommodative monetary policy and improving corporate profits supported equities, but returned this year. The increased volatility is due to several factors. First, the energy sector has struggled due to a stubborn over-supply of crude oil and OPEC’s reluctance to serve in its traditional role of swing producer to balance global oil markets. Second, traders have attempted to predict the timing of the Federal Reserve’s initial rate increase after years of a near-zero Fed funds rate. Third, equities, while not in bubble territory, have advanced significantly over the past two years and currently trade at above-average historic valuations. Last, the role that the financial media plays in market volatility should not be discounted. Media outlets of all forms, financial included, benefit from sensationalism and fear in their viewership as ratings tend to increase during times of uncertainty. Hence, the almost daily cacophony of negative financial news reports claiming the next great economic crisis and/or market collapse is imminent.

In reality, most equity sectors are well below bubble valuations (approximately 20 P/E for the S&P 500 compared with 30+ during the housing bubble), corporate profits are rising, and central banks throughout the world are enacting massive asset purchase programs to stimulate economic growth. Volatility is inevitable as U.S. equity investors transition from a focus on the Fed and monetary policy to a focus on fundamentals and the Fed continues to dial down its historically accommodative policies of the past 5+ years. Therefore, while investors should expect periodic 5% or more corrections – bull markets experience at least three per year on average – equities remain attractive compared to other asset classes, particularly fixed income.

Specifically, we believe there are attractive investment opportunities in the energy sector, due to the recent sudden collapse in the price of crude oil, as discussed below. We also believe that companies with significant business operations in Europe will benefit from the European Central Bank’s recent stimulus efforts there, despite foreign exchange currency headwinds for U.S. exporters and multi-nationals. Certainly the equity markets are not broadly cheap, like they were in the immediate aftermath of the financial crisis, however there remain attractive opportunities for investors with the right perspective and patience during market volatility. Additionally, banks and life insurance companies will benefit when interest rates eventually rise in the U.S., as banks earn greater profits as interest rate spreads increase and life insurers earn a greater return on premiums. Finally, the pace of technological advances in the healthcare and large biotech sector seems to increase each year. While valuations are high (and thus we are not aggressively buying within the sector), we continue to view the healthcare sector favorably.

Crude Oil Weakness Continues

A major contributor to the ongoing market volatility is the continued weakness in the price of crude oil. Through February, oil had traded higher or lower by 2% over twenty times, whereas the same price move occurred only three times in the first two months of 2014. As we discussed in our year-end market commentary, the sudden and unexpected collapse in prices, and ensuing volatility, is due to several factors. First, demand for oil has weakened somewhat due to economic struggles in Europe, China and Japan. Traders are also pricing into the futures market a further expected drop in demand due to ongoing concerns with these weakening international economies. Second, global oil production has flourished thanks in part to the significant technological advances made in the United States by shale oil producers – this has led to crude oil inventories growing to an 80 year high. Third, thanks to the Fed’s expected interest rate hike and opposing monetary accommodation overseas, the dollar has strengthened significantly against foreign currencies in 2015. Last, and perhaps most important, OPEC has announced that it will not cut production to support global oil prices, as it seeks to force the hand of U.S. producers to cut production first. OPEC is primarily concerned with maintaining its global market share, as prior OPEC production cuts have allowed other producers to keep pumping oil while benefitting from high prices.

We believe that the current ~ $45 per barrel price for WTI crude oil is not sustainable over the long term, and that eventually prices will settle around $70-$80 per barrel - near the low-end of the pre-collapse crude trading range. Whether this bounce occurs rapidly or slowly, and whether it reaches these levels by the end of 2015 or takes a couple more years, is extremely hard to predict and depends on a number of variables, including political stability in the Middle East. We do know that shale producers can adjust production much faster than in the past with traditional wells, and this lends support to the theory that U.S. producers will eventually cut enough production to balance the supply and demand equation. We also know, however, that U.S. producers are preparing for a persistently low energy price environment by cutting costs to become similarly profitable at the $60-$70 price range as they were at over $100 per barrel. Therefore, it appears that elevated inventories will likely persist until the economic picture in Europe and Asia improves significantly or OPEC reverses course to cut production under pressure from the likes of Iran, Venezuela, and Nigeria (countries that need higher prices to balance their budgets).

Monetary Policy Developments

A great deal of market volatility in the first quarter can be attributed to investor concerns over the path of short-term interest rates and the likelihood of interest rates rising in 2015. Underpinning much of this concern is the increasing divergence between the Fed’s “threat” to raise rates and the easy money policies pursued by many foreign central banks.

In the U.S., commentators have expended a great deal of energy attempting to predict when the Federal Reserve will announce an increase in the federal funds rate. The Fed has been extremely patient in waiting for economic data to reach its targets prior to raising rates. Specifically, the Fed is examining U.S. labor and inflation data to reach levels consistent with the Fed’s mandates to promote maximum employment and price stability.

With respect to employment, the data is showing that the U.S. labor market has made significant strides. The unemployment rate now sits at 5.5%, down from a recession high of 10% in 2009. While the decline in the unemployment rate is clearly a positive indicator for the U.S. economy, the peripheral employment data is not as strong and this is one reason why the Fed has not raised rates yet. For example, the labor force participation rate (the number of workers and those actively looking for work as a percentage of the labor force) currently sits at an over 30 year low of 62.8% and the number of under-employed workers (e.g., including those workers who are working part-time for economic reasons but would prefer to work full-time or marginally attached to the labor market) is currently 12%.

On the inflation front, the U.S. is experiencing persistently low inflation. For example, the Consumer Price Index, the most well-known measure of inflation in the economy, currently reflects that consumer prices have remained flat over the past year and rose only 0.2% in February. Low energy prices have contributed to inflation data stagnating near zero, well below the Fed’s 2% annual target. Further evidence of low inflation is apparent in the lack of real wage growth in the economy, which is typically evident in a healthy inflationary environment. The Fed will continue to monitor several inflation data points to determine whether inflation is on the path to return to a normalized 2% rate prior to raising the Fed funds rate in 2015.

In contrast to the United States, many countries in the developed world are increasingly pursuing accommodative monetary policies. In early March, the European Central Bank (ECB) announced the details of its much-awaited asset purchase program, similar to the “quantitative easing” programs championed by the U.S. Federal Reserve. The ECB plans to purchase over €1 trillion of European government debt through at least September 2016. If the Fed’s quantitative easing programs are any guide, the ECB program is very likely to be expanded or lengthened until its intended inflationary impact is realized. At the same time, Japan continues to pursue an easy money policy to devalue the Yen and spur growth after many years of economic malaise. China also recently announced its own “prudent monetary policy” of lowering bank reserve requirements to encourage banks to increasing lending.

The monetary accommodation implemented by foreign central banks will have significant implications for financial markets, both domestic and abroad. The most immediate and obvious consequence has been the significant appreciation of the dollar. Since January 1, the dollar has risen by more than 20% against the euro, because of the interplay between monetary accommodation in Europe and potential tightening in the U.S. While currency fluctuations are often transitory and mean-reverting over the long term, in the short term, the stronger dollar has economic significance for more than just U.S. travelers with international vacation plans. Importantly, U.S. multi-national businesses and exporters with significant sales overseas will report on average lower earnings for 2015 as their overseas profits are translated in U.S. dollars. Thus, many analysts have significantly reduced expectations for S&P 500 corporate earnings in 2015, in part due to currency effects. On the other hand, U.S. importers purchasing foreign products that comprise a significant input to production or portion of sales revenue will benefit from the stronger dollar. This includes many retailers that buy foreign goods for resale in the U.S.

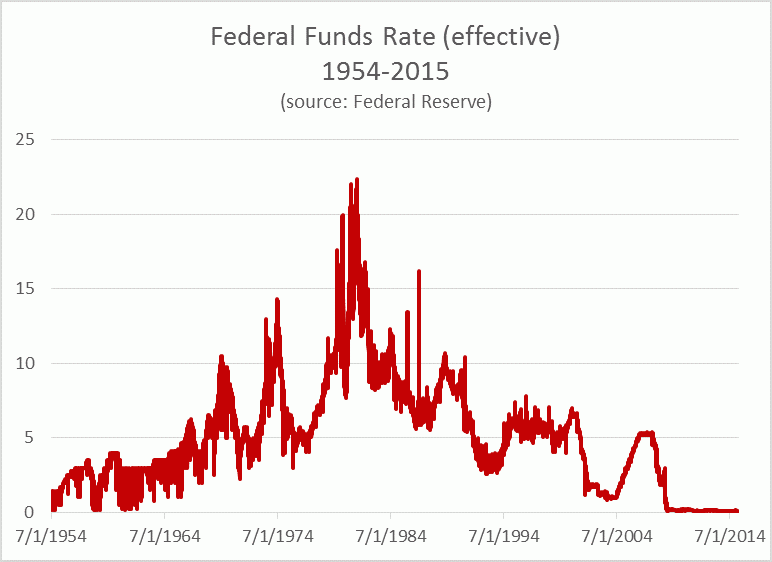

With this background, we believe that the Fed will continue to be cautious in raising rates while other central banks pursue opposite policies. If the Fed does raise rates during the second half of the year (most likely in September), the rate increase will likely be a token amount, and nowhere near the historical norm. (See chart.) Ultimately, the Fed is more concerned about raising rates too soon, not too late, and hindering the economic recovery, much like the Fed’s rate decisions in the late 1930’s are believed to have led to the continuation of the Great Depression.

As usual, all comments are welcome.